EIC: UK offshore wind buildout threatened by infrastructure gaps

Published by Jessica Casey,

Editor

Energy Global,

Britain risks missing its 2030 offshore wind target of 55 GW (5 GW floating) due to infrastructure bottlenecks, according to a new report by the Energy Industries Council, the world-leading trade association for the energy supply chain.

Despite a UK project pipeline totalling 96.4 GW (51.4% floating), only 43 GW – including just 818 MW of floating capacity – is achievable by the 2030 deadline. Only seven projects, out of 82, have reached final investment decisions (FID).

The EIC UK & Europe Offshore Wind report flags severe infrastructure and supply chain constraints across the continent that directly affect UK delivery. Out of about 80 specialist installation vessels operational in Europe, only five can handle 14 – 15 MW turbines – a Europe-wide limitation that impacts UK projects competing for the same assets. Port expansions require 6 – 10 years from permit to operation, clashing directly with project timelines. FIDs and port capacity must align with auctions to land 2030 numbers, as UK projects now hinge on commitments with ports, grid, and the supply chain.

The UK’s future Allocation Round 8 (AR8) of the Contracts for Difference (CfDs) scheme in 2026 – the government’s main mechanism for supporting low-carbon electricity projects by guaranteeing a fixed ‘strike price’ for the power they generate – is too late for 2030 delivery, and the current round (AR7), with results due from December 2025 to February 2026, cannot bridge the gap. The report, which draws on data from EIC’s proprietary energy project and supply chain data-bases, flags port readiness and supply-chain availability as active risks.

A UK offshore wind decommissioning wave is projected to start mid-next decade. Notable retirements include RWE’s Scroby Sands (2027 – 2031) and, later, London Array (175 turbines) toward 2038. RWE’s Scroby Sands wind farm, an early-generation project off Great Yarmouth, is scheduled for retirement between 2027 – 2031. This has the potential to add further strain on ports and other sup-porting infrastructure already under pressure from new build.

The UK’s infrastructure crunch mirrors broader European challenges as the continent pursues its own 411 GW offshore pipeline across 386 projects (37% floating). About 84% of these European projects remain in planning or feasibility stages. Most additions will come post-2030 as projects scale to multi-gigawatt size.

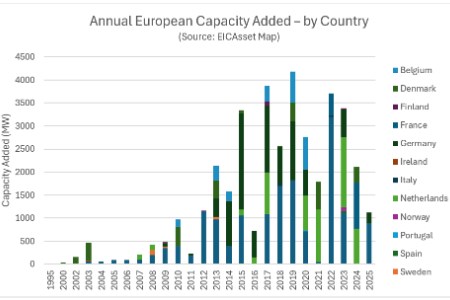

The UK leads Europe’s operational offshore wind capacity with 15.6 GW, followed by Germany at 9 GW and the Netherlands at 5.5 GW. Europe holds 43% of global capacity and commissioned 2.7 GW of the 4.2 GW added over the past year (excluding China). By basin, the technology split is clear: fixed-bottom still dominates the North Sea and Baltic, whereas floating – now accounting for 37% of the proposed pipeline – is essential for the Mediterranean and Southern Europe. Europe has 37.8 GW already operating across 150 wind farms (7178 turbines).

Against this backdrop, a close look at continental Europe's key players shows that Germany faces headwinds despite 31.1 GW in development. ‘Negative bidding’ in auctions is expected to raise costs for consumers/supply chains. In Germany, prices fell sharply (€1.8 million/MW in 2023 to €0.18 million /MW in 2025), a trend that can strain margins and slow delivery as seen with the latest auction receiving no bids. However, infrastructure limits are also a major brake on reaching the 30 GW target, with only 21.6 GW expected by 2030. Meanwhile, France advanced floating wind via its 2024 auctions, awarding the world’s first subsidy to a commercial floating development, and Norway awarded a fixed-bottom CfD (€99.4/MWh) in 2024 to the Sørlige Nordsjø II project.

These national snapshots sit within an EU push to unblock bottlenecks and speed build-out. The drive is based on three levers, including the Wind Power Package, the Net-Zero Industry Act (NZIA), and the Clean Industrial Deal. The focus is on faster permits, auction reform, and access to finance. Under the NZIA, at least 30% of annual auctioned capacity must be awarded on non-price criteria, meaning projects are judged not only on cost but also on factors such as supply chain resilience, sustainability, innovation, and job creation. The European Investment Bank (EIB) is providing €6.5 billion in counter-guarantees for wind manufacturers and €250 million for mid-sized green manufacturing, with port upgrades at Esbjerg, Cuxhaven, Cork, and Bilbao in scope. A second pressure track is decommissioning in the 2030s, with about 366 turbines in 2035 and 540 in 2038 due to come offline. That load draws on the same vessels, ports, and finance.

“The numbers tell a simple story, which is that Europe has scale in the pipeline, but delivery hinges on ports, vessels, auctions and faster investment decisions. Where those align, capacity arrives. Where they don’t, targets slip,” said report co-author, Sharanya Kumaramurthy, EIC Market Intelligence Manager (CAPEX).

The report was also written by Christopher Shirley, EIC Market Intelligence Manager (Supply Chain) and Thomas Bacon, Market Intelligence Manager (OPEX & Decommissioning).

According to the report, Chinese original equipment manufacturers (OEMs) outpace Europeans on annual installations, with manufacturing capacity roughly four times Europe’s (82 GW vs 20 GW). They supply turbines to Germany and Italy, with Mingyang planning to manufacture its 18.8 MW turbine model in Italy (under an MoU with Renexia) to supply projects like Med Wind. The report warns against repeating Europe’s solar experience (95% Chinese module market share) without robust auction design and industry support.

Rebecca Groundwater, EIC’s Global Head of External Affairs, stated: “Policy must lock in a predictable run of work and enable supply-chain finance. Use non-price criteria well, accelerate port upgrades, and keep capital flowing through EIB and national tools. That's how Europe converts a 411 GW pipeline into steel in the water.”

“The UK is aiming for 55 GW by 2030, but the current pipeline points to 43 GW at best – with just seven projects at FID and key sites like Scroby Sands and the London Array heading for retirement, the focus has to be on getting new capacity to shore before the decade is out.”

For more news and technical articles from the global renewable industry, read the latest issue of Energy Global magazine.

Energy Global's Summer 2025 issue

Dive into the latest renewable energy insights in the Summer issue of Energy Global, out now! This edition features a guest comment from Change Rebellion on the role real change management can play in the global energy sector before a regional report, which looks at energy trends and transformations across the Americas. Other key topics are also explored, including offshore support vessels, floating wind, weather analysis, and battery storage. Contributors include Ørsted, CRC Evans, Miros, Solcast, and more, so don’t miss out!

Read the article online at: https://www.energyglobal.com/wind/28082025/eic-uk-offshore-wind-buildout-threatened-by-infrastructure-gaps/

You might also like

Energiequelle begins construction on Lüben wind farm

Energiequelle GmbH has begun construction of the Lüben wind farm in the district of Gifhorn in Lower Saxony in Germany.